Revenue Stamp Act

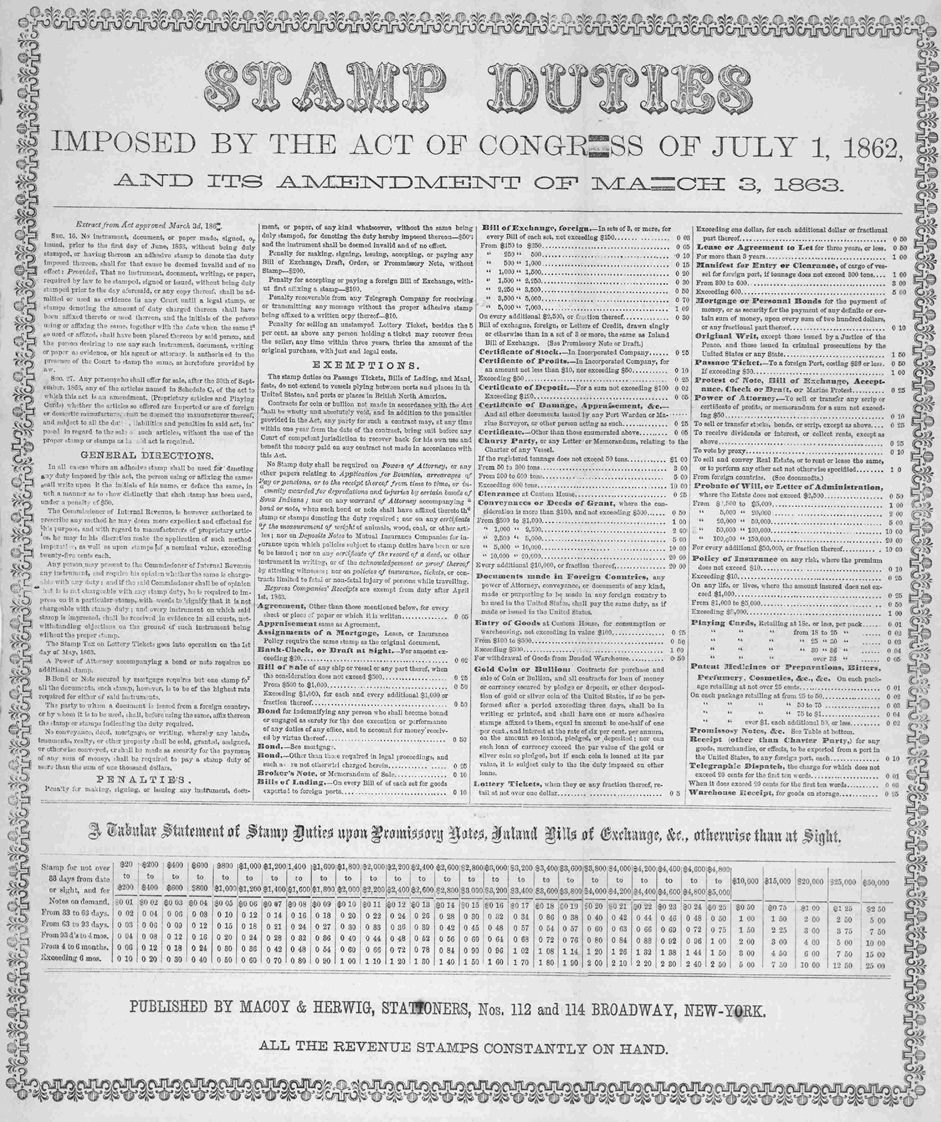

Schedule B of the Revenue Act provided a tax be paid on certain documents which required an adhesive stamp be placed directly on the document to prove the tax was paid.

The cost of the stamp would be equal to the retail value of the document. This required that 92 new and different revenue stamps be created. When the Law went into effect, only the one and two cent stamps were available.

The purchaser would then have to "cancel" the stamp by writing their initials and the date on the stamp. Not using the stamp(s) would result in a fifty dollar ($50) fine in addition to the document being declared invalid.

Because of the Civil War, the majority of the taxable documents were bank checks and sight drafts, real estate transactions, insurance, bonds, and powers of attorney. In 1864, the tax was amended to include all types of checks.

Revenue stamps were used off and on in the decades to follow with the most recent use being in 1960.